Impacts of Conservation Land on Property Taxes and Municipal Budgets in Maine

How does land conservation impact mill rates and town budgets in Maine?

This project was co-created by the University of Maine School of Forest Resources and the Municipal Budgets and Conservation Working Group, a diverse group of conservation professionals, municipal leadership, selectboard members, town managers, and others who want to understand the impacts of conservation on their communities.

Using a mixed methods approach, we measured the impact of conservation on property tax rates (referred to in this study as the “mill rate”) and municipal budgets in Maine. We ran analysis on available data, controlling for confounding variables, conducted a public perceptions survey, and engaged with 20 professionals through interviews. From our findings, we provide recommendations for municipal and conservation decision makers.

Executive Summary Document “How does land conservation impact mill rates and town budgets in Maine? A mixed methods study”

Abby Bennett’s master’s thesis can be accessed here and a slide deck presentation of the study can be accessed here.

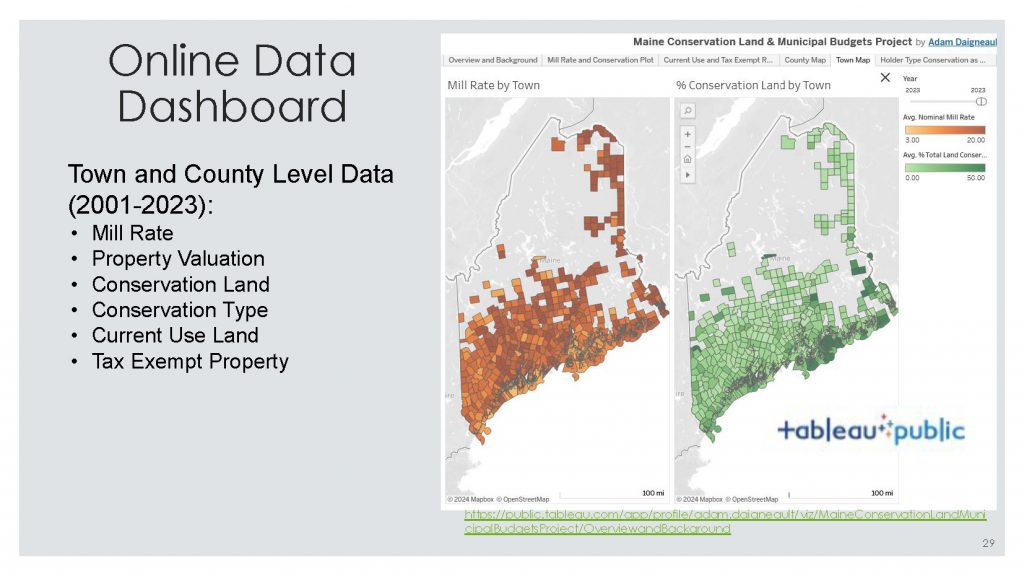

Please see the Tableau Page for an online data dashboard that provides town and county level data on conservation, mill rates, and other variables.

Overview and Background

Conserved land in Maine has increased significantly over the last thirty years. Conservation in Maine has increased from 5% of the state’s land area in the 1980s to more than 20% today including in the Unincorporated Townships.

When land is conserved in Maine, it is often granted tax exempt status or taxed at the Current Use rate which theoretically reduces the tax base of the town. Using simple accounting, the town would need to cover the budget deficit by increasing the mill rate. However, the impacts of conservation on communities are complicated in the short and long run.

When land is conserved in Maine, there may or may not be a change to the tax base of the town or County. There would not be a change when the land was already enrolled in Tree Growth, Open Space, or Farmland Current Use tax programs prior to their conservation, and conservation may not cause a change in tax rates. Some land changes from non-exempt to fully exempt, including many public agencies. Many conservation organizations, but not all, have a consistent practice of making payments in lieu of taxes to avoid or minimize impacts to municipal or County budgets.

Conservation can provide ecosystem services and amenity effects on surrounding properties, attract tourism, and limit development, all of which could impact a town budget. This was demonstrated through a study commissioned by Downeast Conservation Network to comprehensively assess the economic contributions of conserved lands.

“Valuing the Economic Benefits of Conserved Land in Downeast Maine“

The report includes economic valuation of ecosystem services provided by regional conserved lands: benefit transfer valuation of non-market ecosystem services, direct valuation of market-based ecosystem services, and calculations of visitor spending effects and employment contributions to the local economy. While this study helped fill important data needs, it did not explore the larger suite of impacts, including but not limited to land conservation, on municipal budgets.

Municipalities in Maine face many challenges in maintaining balanced budgets. Among them, a decrease in state revenue sharing and funding for general purpose aid to education, impacts from tree growth and open space tax laws, property tax revenue loss from Federal, state, private or non-profit conservation lands, and other lands in some form of non-profit status. The loss of revenue and increase in costs have meant rising property taxes and the increase in property taxes has a disproportionate impact on the poor and elderly.

Municipal Budgets and Conservation Working Group Quick Facts:

- Established in 2019 lead by Washington County Council of Governments and Downeast Conservation Network.

- A collaborative group of conservation professionals, researchers, municipal leadership, selectboard members, and town managers and others who have joined together to collect and analyze data on the many factors impacting municipal budgets in the Downeast region and across the state of Maine.

- Focused on gathering and sharing information based on data, rather than perceptions.

- Created to develop a transparent and collaborative process to provide feedback to the research study

The Municipal Budget and Conservation Working Group is based in the Downeast region but is focused on addressing the impacts of state-wide policies on rural municipalities across the state of Maine.

To learn more about the participants and background of the Working Group, click here.

For more information, contact Erin Witham at [email protected]

Local News Coverage

For more information about the background of this issue and the working group, check out these local news articles:

“Group tackles land conservation programs’ impact on local taxes” The Quoddy Tides, December 14, 2018

“A coastal conundrum – taxes or tourism” The Working Waterfront, August 13, 2019

“Group to study impact of conserved lands” The Quoddy Tides May 22, 2020

Background Data and Research

Thank you!

This project is made possible by funding from the Elmina B. Sewall Foundation, the Maine Community Foundation – Community Building Grant Program and Donor Directed Funds, along with the time and resources donated by our working group members.